Splinter.com claimed that Amazon made $3.6 Billion dollars in profits last year and yet paid no income tax.

Jeff Bezos is the richest person in the world, with a personal net worth of $108 billion. In 2017, Bezos’ company, the internet retail giant Amazon, reportedly took in $5.6 billion in U.S. profits.

So, how much did Amazon pay in income tax on that bounty? Hang on, we’re getting some news…what? What’s this? Amazon effectively paid zero dollars in federal income taxes in 2017? Oh.

Amazon is projecting a $789 million windfall from Republicans’ tax bill, according to the Institute on Taxation and Economic Policy, which may have factored into its reason for witholding taxes this year. Bezos—like many other nominally liberal capitalists—claims to disagree with Donald Trump’s policies, while quietly lapping up the Republicans’ regressive tax breaks.

You may be asking: How is this legal? Isn’t Amazon an American company? Aren’t companies required to pay federal income tax? Hello?

Amazon’s global headquarters is not in Seattle, but in the tiny landlocked nation of Luxembourg (Amazon employs more than 40,000 people in Seattle, compared to 1,500 people in Luxembourg.). The European Union has accused Luxembourg of giving illegal tax breaks to Amazon and has ordered the country to recover $295 million in back taxes from Amazon.

Our provision for income taxes in 2017 was lower than in 2016 primarily due to excess tax benefits from stock-based compensation and the provisional favorable effect of the 2017 Tax Act, partially offset by an increase in the proportion of foreign losses for which we may not realize a tax benefit and audit-related developments.

Jeff Bezos’ obsession with avoiding taxes goes back to Amazon’s inception. In 1995, Bezos originally wanted to build Amazon’s U.S. headquarters on a Native American reservation near San Francisco because it offered a tax break. But California stopped the deal from going through.

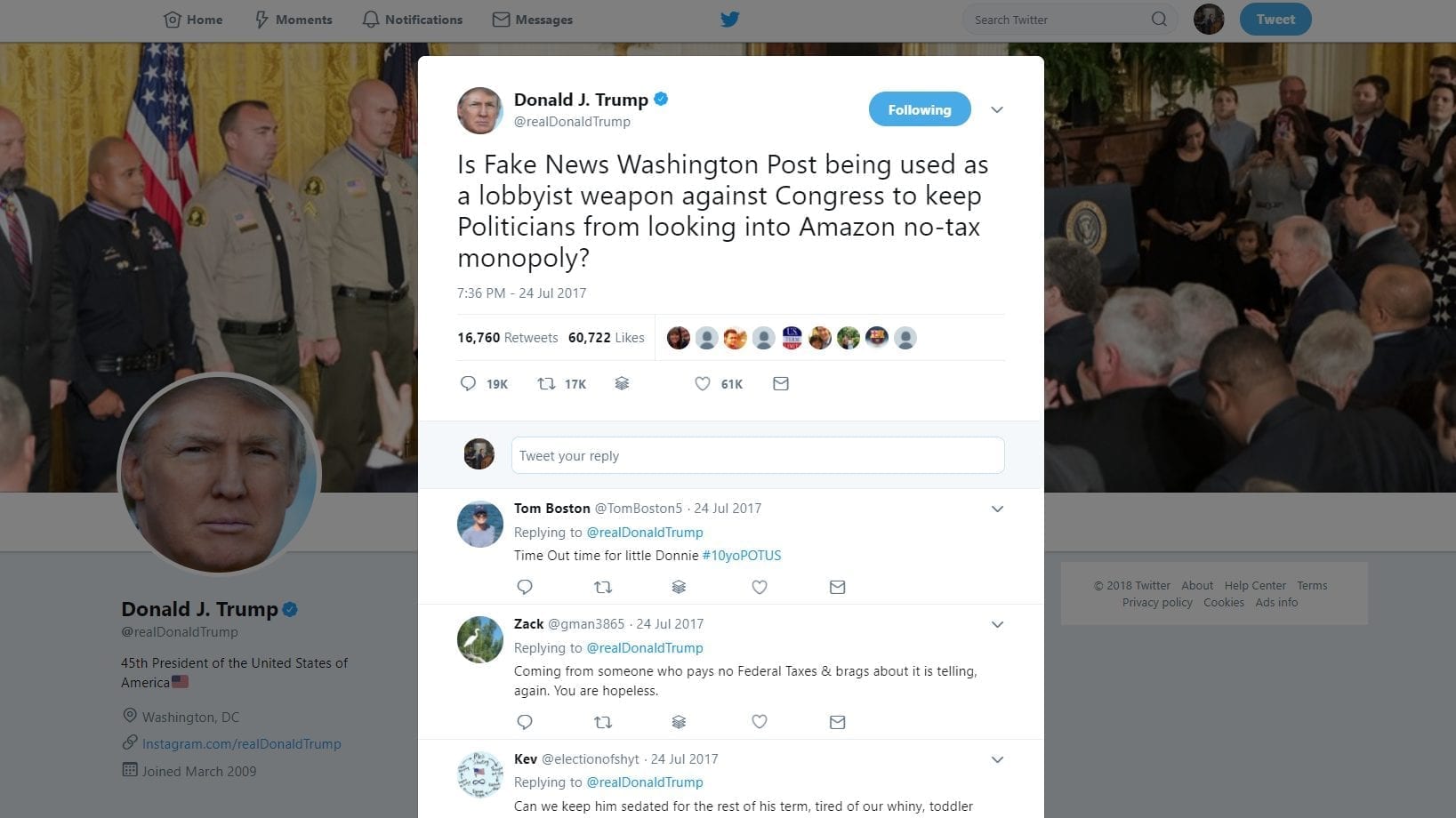

Is Fake News Washington Post being used as a lobbyist weapon against Congress to keep Politicians from looking into Amazon no-tax monopoly?

— Donald J. Trump (@realDonaldTrump) July 25, 2017

It is time for Trump to action on this. Trump cut taxes for over 80% of hardworking Americans, all small business and helped big corporations which in turn gave their employees compensation for it. That doesn’t mean that large corporations won’t still try and game the system, however. Amazon should pay whatever the law states it should and not be able to squeeze around paying that through loopholes.

Now, of course, Politifact gave this claim a “pants on fire rating” and the media attacked the President but he was in fact correct.